Mrs Zainab Ahmed, the minister of Finance, Budget and National Planning, says the federal government has introduced excise duty of N10 per litre on all non-alcoholic, carbonated and sweetened beverages.

She said this on Wednesday in Abuja at the public presentation and breakdown of the 2022 budget.

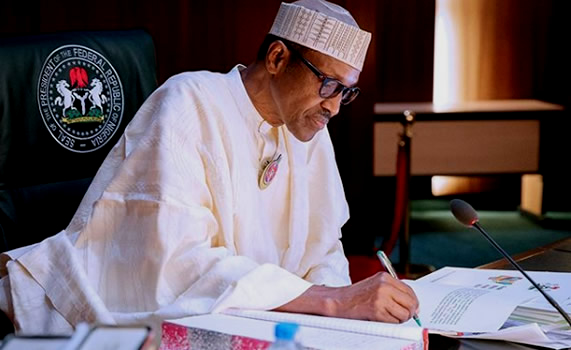

According to her, the charge on beverages is a new policy introduced in the Finance Act signed into law by President Muhammadu Buhari on Dec. 31, 2021 alongside the 2022 Appropriation Bill.

The National Assembly raised the total 2022 budget figure from the proposed N16.391 trillion to N17.126 trillion.

The budget was passed with the crude oil benchmark increased from 57 dollars per barrel to 62 dollars per barrel.

Ahmed said the new ‘Sugar Tax’ was introduced to raise excise duties and revenues for health related and other critical expenditures in line with the 2022 budget priorities.

She also said it was aimed at discouraging excessive consumption of sugar in beverages, which contributed to diabetes, obesity and other diseases.

Ahmed added that the Finance Act also raised excise duties and revenues for the health sector.

Also under the Act, she said provision was made to reinforce the Federal Inland Revenue Service’s (FIRS) mandate as the principal tax collection agency while collaborating with other law enforcement Ministries, Departments and Agencies (MDAs).

She also said FIRS was empowered to assess and tax non-resident firms on turnover earned from providing digital services to Nigerian customers.

“Note that such digital services include apps, high frequency trading, electronic data storage and online advertising,” she said.

She also said the revenue generating agency was empowered under the act to sanction non-compliant taxpayers refusing access to information technology.

On independent revenue collection, Ahmed said as at November 2021, the federal government generated N1.04 trillion, surpassing its N973.41 billion target.

She also said to further enhance independent revenue collection, the federal government aimed to optimise the operational efficiencies and revenue focus of Government Owned Enterprises (GOEs).

Speaking on critical sectoral allocations of the 2022 budget, Ahmed said the education sector got N1.234 trillion with 815.69 billion allocated to the Ministry of Education and its agencies for recurrent and capital expenditure.

She said N112.29 billion was allocated for Universal Basic Education Commission (UBEC), while N306 billion was allocated for Tertiary Education Trust Fund (TETFUND) for infrastructure projects in tertiary institutions.

The health sector, which got N876.38 billion as 5.1 per cent of the total budget, had N770.87 billion go to Ministry of Health and its agencies for recurrent and capital expenditure including hazard allowance.

However, the defence and security sector gulped 13.4 per cent of the budget at N2.29 trillion; infrastructure 8.3 per cent of the budget at N1.42 trillion and N462 billion for social development and poverty reduction programmes.

Ahmed said the 2022 budget was expected to further accelerate the recovery of the nation’s economy, facilitate the completion of critical projects and improve the general living conditions of the people.

She added that the budget reflected the key execution priorities and strategies of the National Development Plan (NDP) 2021-2025.

“Government will continue to create the enabling environment for private sector to increase their investment and contribute significantly to job creation, economic growth and lifting millions of our citizens out of poverty.

“Early passage of the 2022 budget for implementation from Jan. 1, will significantly contribute towards achieving government’s macro-fiscal and sectoral objectives,” said the minister.