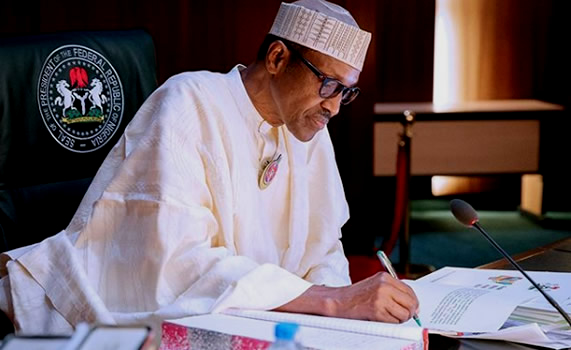

When President Muhammadu Buhari inaugurated the board of the Revenue Mobilisation, Allocation and Fiscal Commission (RMAFC) on June 27, 2020, he charged the members to be fair and just to all tiers of government.

He warned them not to compromise the Commission’s constitutional mandate for whatever reasons.

The RMAFC was established by law to monitor the accruals into and disbursement of revenue from the federation account.

The Commission is to also review, from time to time, the revenue allocation formula and principles in operation to ensure conformity with changing realities.

The Commission is also expected to advise the federal, state and local governments on fiscal efficiency and methods by which their revenue is to be increased, among others.

Chief Elias Mbam, its chairman, who spoke to State House correspondents after the inauguration, said that the Commission would work toward increasing the revenue shared by federal, state and local governments.

He said that the president was emphatic in tasking the Commission to deliver on its mandate, adding that it will work towards that.

“We need to increase the sources of revenue to the federation account; in other words, we will concentrate more efforts on how to increase the size of cake for allocation to the three tiers of government, instead of struggling to share a shrinking cake.

“So, the Commission will key into the diversification programme of the Federal Government with a view to finding other sources of revenue that will increase resources to the federation account.

“One of our responsibilities is to review the revenue allocation formula and I am saying that we will deliver on our mandate.

“The issue is not just to add and subtract; it derives through a process; whatever you get is derived through a process; more responsibilities, more money,’’ Mbam said.

It was to ensure a transparent process that the Commission recently embarked on a two-day Public Hearing on Review of Revenue Allocation Formula, in each of the six geo-political zones.

Echoes from the public hearings indicated great yearning for review of the current revenue sharing formula. It’s a unanimous song that the status should change.

The consensus of the states is a reversal of the current sharing formula: 52.68 per cent to the Federal Government, the states 26.72 per cent, the local governments, 20.60 per cent, with 13 per cent derivation revenue going to the oil-producing states.

Mbam at the Lagos venue for the South-West, reiterated that the revenue allocation review was not intended to change the fiscal arrangement of the country.

“Whether we are devolving power or going into a complete system of federalism or we are restructuring, is not the concern of this review.

“The review of the mobilisation and revenue allocation is a product of law and an Act provided by the 1999 Constitution as amended,’’ he said.

The RMAFC boss explained that the height of responsibility of any of the three tiers of government would determine what it would get.

He said: “If the Federal Government is confirmed to have a high responsibility, it will get an equivalent of that responsibility as allocation.

“If it is the local government that has more responsibility, it will be done the same way. Our position is that the more responsibility of a tier, the more money it gets.’’

Gov. Babajide Sanwo-Olu of Lagos State, who spoke at the South-West public hearing said upward would enable the states to cater for their rising responsibilities.

The governor said that the present revenue sharing formula among the tiers of government which became operational about 29 years ago was long overdue for amendment.

“Nigerian fiscal federalism should be adjusted to develop more expenditure responsibilities with appropriate revenue allocation to lower levels of government.

“So that Federal Government will focus on matters of national concern like security and defence, among others.

“The Lagos State Government proposed revenue allocation formula: Federal government: 34 per cent, states 42 per cent, local government councils, 23 per cent and Lagos State (Special Status, 1 per cent).

“The solution is to diversify and strengthen the fiscal base of the state government.

“The need to reverse the age-long fiscal dominance by the Federal Government in order to re-establish a true federal system is strongly recommended.’’

The governor pointed out that there was a need for effective fiscal laws that would ensure a framework for beneficial and dynamic intergovernmental fiscal relations.

“This will help in nurturing strong, transparent, efficient and independent fiscal institutions that will also help in nurturing strong transparent, efficient and independent fiscal institutions.

“This will further ensure accountability and proactively address emerging fiscal challenge in the public sector,’’ the governor said.

Dr Adekunle Wright, RMAFC Federal Commissioner, who also spoke, promised that the Commission would do a good job.

“Lagos as much as we know in per square meter is the smallest in Nigeria, but highest in the number of people per square meter, all of these we are taking into consideration and take on board.

“The revenue that Nigeria generates belongs to Nigerians, the revenue accruable in Nigeria belongs to all, so all of these things have been taken into consideration to ensure fairness."

Dr Rabiu Olowo, Lagos State Commissioner for Finance, stressed that the state ought to get more from federal allocation.

“It is very important that Federal Government reviews the revenue allocation formula of Lagos State because of the high rate of daily influx of population into the state.

“Lagos State is the smallest in the country, but accommodates 10 per cent of the whole population.

“Due to the daily influx, there is need for federal support. Also the state is shouldering so many of the federal responsibilities.

“Therefore, in line with current realities, it is very important that the federal government reviews the revenue allocation formula.

He said: “There is an aligned position by all stakeholders that the revenue allocation formula should be reviewed in support of the state and local government.

“This is because they are the closest government to the people.’’

Gov. Nyesom Wike of Rivers who spoke at the South-South public hearing held in Port Harcourt aligned with his Lagos State counterpart.

He said that the “Current revenue allocation formula, an outcome of the military fiat as far back as 1992, has gone 22 years of democratic dispensation, obviously could not meet the present realities in the nation.’’

He noted that the Federal Government was over burdened and overloaded and could not efficiently deliver a federal system as envisaged.

“It is just only fair that the Federal Government should reduce its loads and the allocations to the Federal Government should be reduced.

“In that way, most of the responsibilities that belong to the Federal Government will now be taken away and given to the states,’’ he said.

He noted that 1992 population figure, public school enrolment, public hospital bed spaces, land mass were used as formula for the revenue allocation.

The governor called for a more equitable formula which would take into consideration the current population figure, enrolment in private schools and the number of bed spaces in private hospitals.

The participants at the South-East public hearing held in Owerri also called for more revenue allocation to the states.

Gov. Hope Uzodimma of Imo reiterated that the current revenue allocation formula which was last reviewed in 1992 was obsolete, given the reality of the economy and developments that followed the last review.

On his part, the Ebonyi Commissioner for Finance, Mr Orlando Nweze, lamented the imbalance in the sharing formula of the country’s revenue.

Nweze said revenue allocation should be reviewed to 40 per cent for the Federal Government, 35 per cent for state governments and 25 per cent for local government areas.

Mbam, at that event, also reiterated that several socio-economic and political changes since the last review informed the Commission’s decision for the current review.

“To ensure wide coverage of participation, the commission invited memoranda from the stakeholders in both print and electronic media on the review of the revenue allocation formula.

As the agitation continues on how to get large chunk of the `national cake’ especially by the states, Vice President Yemi Osinbajo has an advice for governors – “Think Outside the Box.”

Osinbajo stressed that states should think out of the box to grow their economy and boost their internally generated revenue.

He said the chief executives should concentrate their investments in areas where they have comparative advantages rather than waiting for monthly handouts from the Federation Account.

He gave the advice recently in Ado-Ekiti at the maiden Ekiti Economic and Investment Summit tagged: “Fountain Summit 2021.” It was part of activities to marked the third anniversary of Gov. Kayode Fayemi’s administration.

He said the states should grow their Gross Domestic Product (GDP) like an independent country.

The vice president said: “The attractiveness of investments to any state should be radical, because that is the revenue hub and determinant of how happy the people of any state will be in terms of economic development in relation to their standard of living.

“But, while trying to grow investments, we must be cautious about multiple taxation; it weighs down businesses.’’

Recounting how the Lagos State grew its economy between 1999 and 2007, Osinbajo said: “During my time as a commissioner in Lagos State, we started with N600 million monthly internally generated revenue in 1999.

“The seizure of Lagos State funds by former President Olusegun Obasanjo made us to think like a sovereign state. Today, Lagos State is making over N45 billion monthly.

“The surest way forward is to deepen investments in the areas where states have comparative advantage.

“We should also make good investment in technology to grow the knowledge-economy, which is education.”

While awaiting for the new revenue sharing formula, those clamouring for change of the status quo, should remember, as emphasized by RMAFC, that the exercise is not intended to change the fiscal arrangement of the country. They should also think outside the box in order to `bake their personal cake, as advised by the vice president.

By Obike Ukoh, News Agency of Nigeria